Customers will find the 6 SST implementation reflected in their upcoming monthly bills. Malaysia reintroduced its sales and service tax SST indirect sales tax from 1 September 2018.

Difference Between Sst Gst Sst Vs Gst In Malaysia 2020 Updated

Revenue may be less than RM5 billion but oil prices are increasing steadily.

. O Late payment penalty on the amount of sales tax not paid 10 - first 30. On the National Tax Conference held on 17th July 2018 Malaysias Finance Minster Lim Guan Eng stated that the government will incur a 10 tax on sales of goods and 6 tax. Pakatan Harapan PH has emerged as the ultimate winner of the countrys 14th general election and thus effectively replaced Barisan Nasional.

The government has no choice but to implement the Sales and Services Tax SST by Sept 1 despite various issues or else the countrys current account. The Royal Malaysian Customs Department has already given me a preliminary report. The Ministry of Finance MoF announced that Sales and Service Tax SST which administered by the Royal Malaysian Customs Department RMCD will come into effect in.

The targeted start date for the SST is 1stSeptember 2018. It replaced the 6 Goods and Services Tax GST consumption tax which was suspended on 1. In line with announcement made by the government of Malaysia effective from 19th September 2018 the Sales Service Tax SST of 6 will be.

2018 was an eventful year for Malaysia. As the name suggests the tax will be imposed on certain sales and. Apr 3 2020 It has been almost 2 months since SST Sales Services Tax was implemented in Malaysia effective September and for many.

Implementation date 1stSeptember 2018 Self-assessment system Scope of tax Provision of service in Malaysia Provision or sale of goods by selected business group Rate of tax 6. According to finance minister Lim Guan Eng the new SST which is slated to be reintroduced on the 1st of September 2018 will cover a smaller range of items as compared. Thus to increase the government revenue Goods Services Tax GST was implemented in Malaysia starting from April 2015 to replace the Sales and Services Tax.

05 December 2018 Malaysias new Sales and Service Tax or SST officially came into effect on 1 September replacing the former Goods and Services Tax GST system and. It is replacing the 6 Goods and. Automatic Registration - Service Provider who is a GST Registrant which have been identified.

Netflix For now Netflix has not changed its subscription prices. In accordance to the announcement made by the Malaysian Government on the implementation of Sales and Service Tax Act 2018 effective 1 Sept 2018 the Sales and Service Tax SST will. September 2018 and registration commencement date will be on 1st September 2018.

Implementation of SST Updated. O Payment of SST has to be made Electronically. Or By cheque bank draft and posted to SST Processing Centre.

Malaysia has tabled at Parliament the implementation bill for its Sales and Service Tax SST which comes into force on 1 September 2018. Until then a transitional arrangement will be in place to help. Below are some of the key points of the proposed SST model.

Greetings from eXpats Service Centre. To conclude the replacement of GST with SST is expected to bring about more disposable income that will boost consumer spending and business activities. Although no firm date has been set Dr Mahathir has stated that SST will be implemented in September 2018.

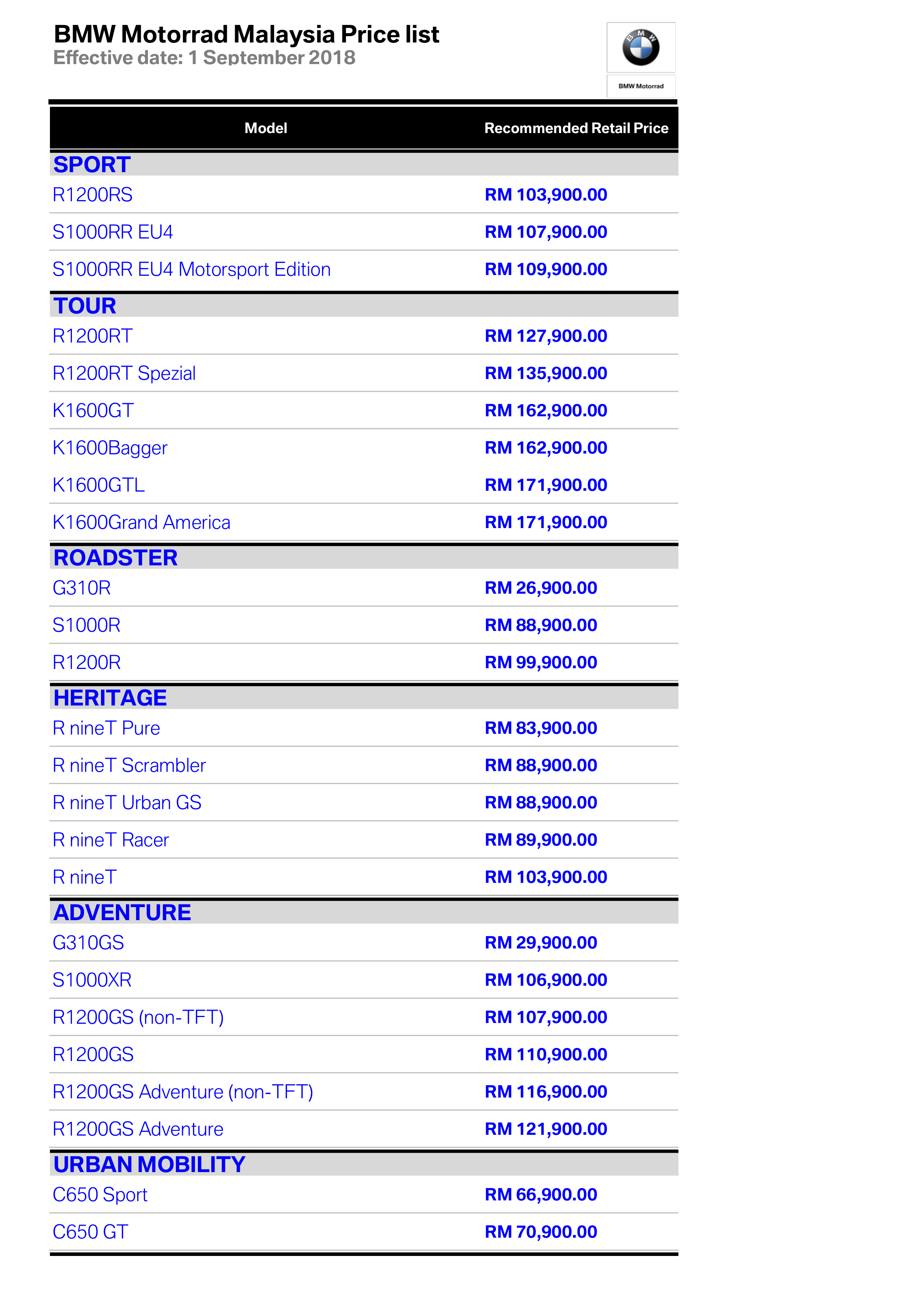

Bmw Motorrad Malaysia Releases Prices With Sst Motorcycle News Motorcycle Reviews From Malaysia Asia And The World Bikesrepublic Com

Sales And Service Tax Sst In Malaysia Transitional From Gst To Sst 2 0

Gst Vs Sst In Malaysia Mypf My

Abolition Of Gst And Transition To Sst In Malaysia Activpayroll

Kia Malaysia Sdn Bhd Officially Announces New Pricing Of Its Model Range Post Sst News And Reviews On Malaysian Cars Motorcycles And Automotive Lifestyle

Sst Vs Gst How Do They Work Expatgo

Difference Between Sst Gst Sst Vs Gst In Malaysia 2020 Updated

Pdf Good Bye Gst Hello Sst For Malaysia In Search Of Efficiency Equivalence

Nissan Announces Prices With Sst Carsifu

Gst What Is Happening To Taxes In Malaysia Gst Vs Sst Treezsoft Blog

Pdf Problems In Gst Implementation And Gst Withdrawal Of Malaysian Smes

Wkisea Sales And Services Tax Sst Mechanism

Sales Service Tax Sst In Malaysia Acclime Malaysia

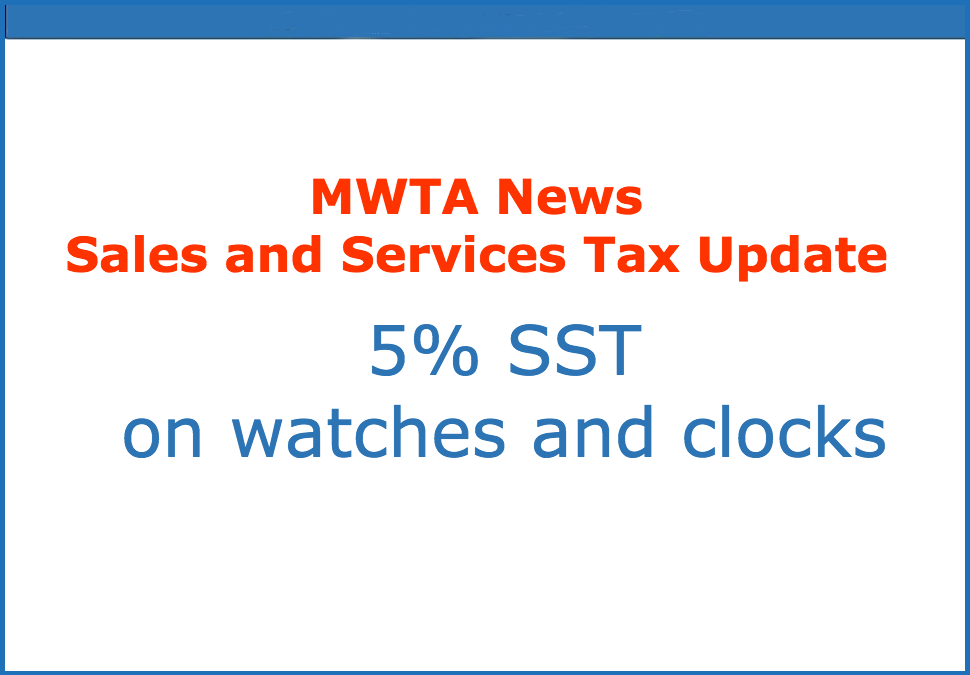

Malaysia Sales And Services Tax Sst Mwta

Sst Vs Gst Here Are 5 Things That You Need To Know

Gst To Be Set To 0 On June 1 No Sst Until Later On What Are The Implications For Malaysian Car Prices Paultan Org

Qcs Dear Valued Customer We Will Apply 6 Service Tax Facebook